The Complete

Credit-to-Cash platform

for finance teams of all sizes

D&B Finance Analytics is the complete AI-driven platform — for finance leaders who want to transform their finance operations and reduce cost through insight, automation and enhance their customer experience.

Easy-to-Implement, Easy-to-Use Configurable Applications for both Credit Intelligence and Receivables Intelligence

Best of both worlds - Credit Intelligence

and Receivables Intelligence

Intelligent

This AI-driven platform features deep insight and machine learning that enhances your internal customer data.

Flexible

Configurable for businesses of every size and need. From multi-national firms to local small enterprises.

Easy to Use

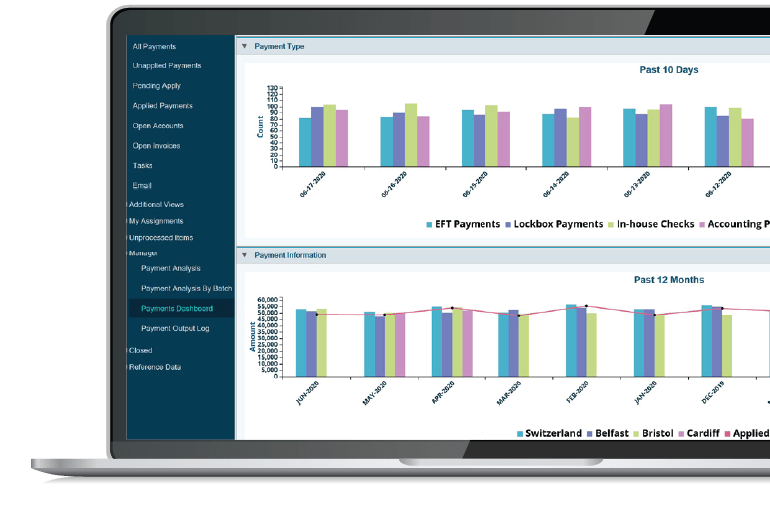

This intuitive platform allows you to easily create and manage workflows to monitor key activities from a dashboard.

Powered by the Dun & Bradstreet Data Cloud

Credit Intelligence

Automate Credit Decisions

Our Finance Analytics – Credit Intelligence delivers AI-driven risk assessments to help users set the right payment terms, understand corporate linkage and collect payment on time.

- Globally consistent financial statements in more than 200 markets

- Online credit application can be configured

- Platform users set-up customised credit scorecards for various vendors

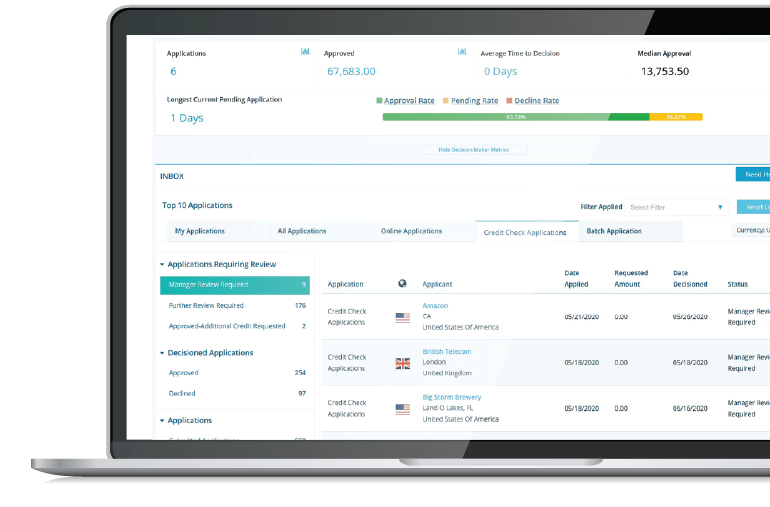

Decision Maker

Manage and Monitor

Configurable alert allows you to receive notifications when a business’s information changes and take appropriate actions.

A dashboard lays out easy-to-read charts and graphs that help you visualise risk, exposure to better understand overall performance.

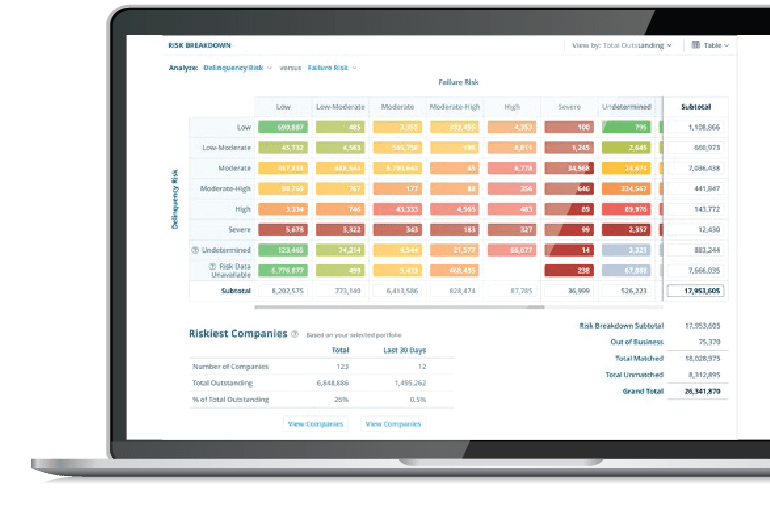

Portfolio Insight

Account Reviews

When a significant change happens to an account, the said account will be flagged for further evaluation:

- Increase / Decrease credit limits

- Re-evaluate credit terms

- Placing a credit hold

D&B Finance Analytics records all actions with automatic time-stamping to leave breadcrumbs for audit and compliance documentation.

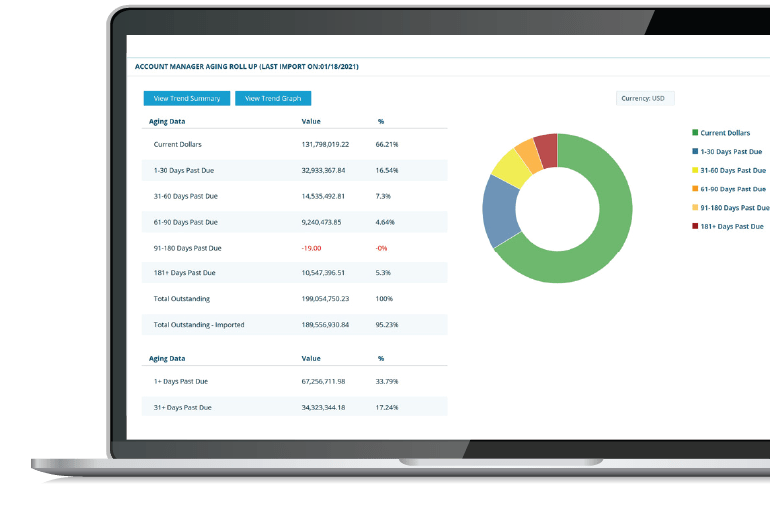

Account Manager

Finance Analytics Credit Intelligence

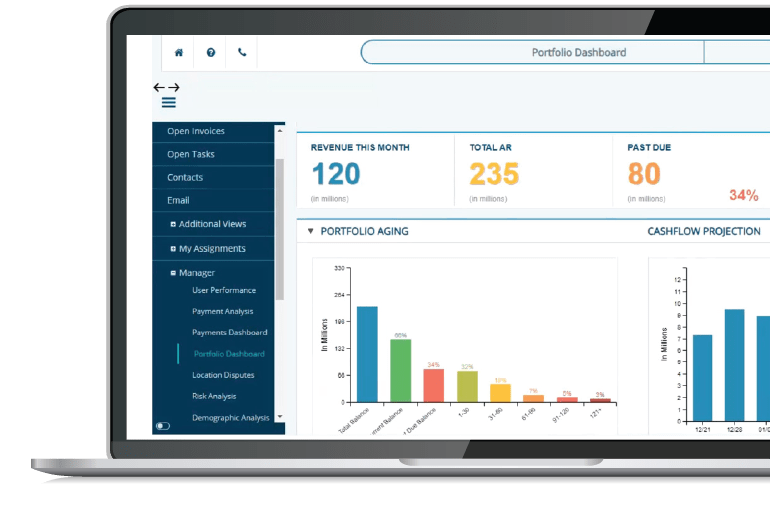

Receivables Intelligence

Streamlined Accounts Receivables

Our Finance Analytics – Receivables Intelligence is a collaborative and comprehensive automated solution that allows you to prioritize collections, manage disputes, and simplify workflows.

- Send automated emails

- Prioritise high-risk accounts

Reduce days past due

Collections Management

Customer Portal

Make easier for clients to pay you with e-invoicing and a secure payment portal.

- Pay online

- Accessible 24/7

- Track payables

- Track orders

- Timely raise order issues

Online Payment Portal

Manage Cash

Automate payment and remittance application with a probability matching tool to help reduce application costs, manual reconciliation, and manual compliance reporting – all while eliminating redundant communication, emails, and exceptions.

- Reduce payment processing costs

- Improve quality of cash numbers

- Reduce DSO

- Enable no-touch processing

Cash Management

Finance Analytics Receivables Intelligence

Start your Finance Analytics Journey Now!

Or just want to find out more? Let us help!