What is ESG?

ESG is the abbreviation of Environmental Protection (Environment), Social Responsibility (Social) and Corporate Governance (Governance). It is a brand-new set of data and indicators for assessing businesses. Corporate social responsibility is represented by ESG. Many businesses or investors may use ESG scores as a key indicator when making investment decisions and determining how sustainable a firm is.

Businesses, investors, and other stakeholders are paying more attention to ESG issues. Today, ESG is an objective judgment based on data rather than a subjective assessment of moral value. Its true focus is not on performing good deeds but rather on the enterprise’s sustainable and progressive management, which emphasizes “resilience” in the form of avoiding risks and defying pressure.

Environmental

Enterprises will need to pay attention to issues related to environmental sustainability, including greenhouse gas emissions and reduction of carbon emissions.

Social

How businesses manage their relationships with employees, suppliers, customers and communities.

Governance

Covers topics such as corporate leadership, executive compensation, auditing, internal controls, and shareholder rights.

D&B ESG Intelligence Platform

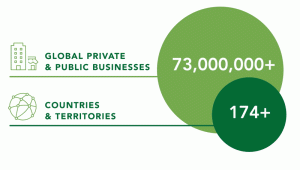

In line with the 6 major international sustainability standards, you can leverage D&B’s 73+ million company data, 13 ESG themes and 31 sustainability topics to examine your company’s ESG “health check” and provide corporate ESG insights through a fair third-party perspective and assist enterprises to achieve sustainable operation.

Create new business opportunities

By establishing an excellent ESG corporate image and brand trust, it will attract more cooperation opportunities, increase the competitiveness of enterprises in the market, and improve profitability.

Assist in ESG compliance management

D&B ESG rating complies with the 6 sustainability principles. It helps to assist companies to comply with relevant laws and regulations, and avoid being fined by regulatory agencies which may cause financial losses or damaging corporate reputation.

Identify ESG risks

D&B ESG has gone through a rigorous verification process to provide a fair third-party perspective and to help companies identify customers or suppliers with outstanding ESG performance and reduce risks.

Create leverage through ESG insights

Our comprehensive D&B ESG Rankings help companies generate insights, strengthen their ESG goals and streamline ESG assessment processes.

Due Diligence

in Your Supply Chain

and Engage Suppliers

Identify and Understand ESG Risks

D&B ESG Intelligence provides comprehensive coverage of sustainability performance data on over 73 million global public and private businesses.

Our ESG Rankings are conveniently organized into 13 ESG themes and 31 topics to help you understand specific risks and opportunities.

Actively Monitor ESG Risks and Engage Suppliers

Effectively monitor your suppliers’ ESG risks and support routine audits easily. Our ESG data is refreshed on a frequent cadence and provide up-to-date insights so your team can mitigate risk proactively.

- Easily monitor ESG performance of your full portfolio of suppliers

- Identify specific ESG risks to engage with your suppliers about

- Proactively pivot when a supplier’s ESG risk factors shift

- Benchmark ESG performance against industry averages

Enhance ESG Insights of Suppliers in Your Portfolio

D&B ESG Intelligence provides a deployable survey which is sent by Dun & Bradstreet to suppliers in order to enhance ESG metrics.

- Aimed to help you gain hard-to-retrieve data to complete ESG evaluations of suppliers

- An easy method of engaging with your suppliers for more insight

- Deployed via a click of a button in D&B Risk Analytics, initiating a request by Dun & Bradstreet on your behalf to complete the ESG self-assessment survey

Click here for ESG self-assessment.

Connect with us

Questions or Problems? Let us help.