Credit Risk Solutions

Evaluate and reduce your business risk

As your credit risk management partner, gain access to over 450 million business credit records at your fingertips. Confidently assess the risks associated with your customers and limit credit risk exposure.

Depending on the nature of your business transactions and your level of credit risk exposure (and risk appetite), we offer a range of credit reports ideal for your assessment.

Business Credit Report

Business Credit Reports comes in any shapes and sizes – just like umbrellas, thicker ones will shade you better from the sun, curved ones will protect you better from the rain, decorative parasols to match attires for special events.

Comprehensive Report

The Comprehensive Report provides a complete coverage of information necessary to make confident credit decisions. This report is uniquely made into a narrative format, for easy understanding even for those non-financially trained. The best part of this report comes in the form of a recommended credit range based on a multifaceted historical data.

For High High Risk Transactions

Business Information Report™ (BIR)

A detailed business credit report for business credit decisions, the Business Information Report™ help mitigate potential business risks by avoiding payment defaults and assessing a company’s business credit risk with straightforward risk indicator like Payment Summary, D&B® Rating and D&B NCRI.

For High Medium Risk Transactions

Customised Report

Customised Reports bestow the power back in your hands to decide what you want and what you don't.

As requirements will vary, include only the insights and elements you need for maximum efficiency.

For High Medium Low Risk Transactions

Connect with us

Questions or Problems? Let us help.

Credit Scores & Indexes

Our ratings weigh financial and non-financial factors in credit deliberation to derive a more precise and impartial representation. These ensure you obtain a comprehensive and relevant overview that considers a broad spectrum of elements (beyond fiscal) to support confident decision-making.

D&B Rating

The D&B Rating is a value added tool which provides a quick assessment of a company’s Financial Strength and Risk Conditions

D&B New Credit Risk Index (NCRI)

The D&B NCRI gives you the financial standing of a company based on local (Singapore) business standards.

Credit Assessment Rating

The Credit Assessment Rating (CA Rating) serves as a reference to assess a firm’s credit risk and recommend the credit range to be extended.

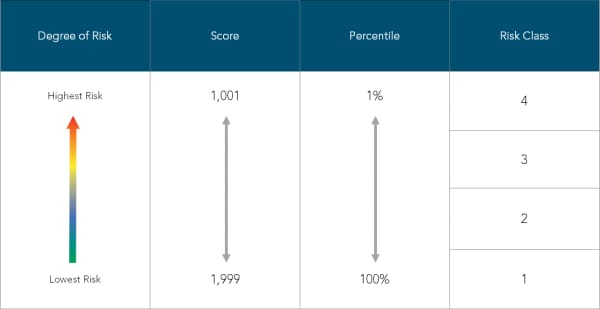

Financial Stress Score

The Financial Stress Score (FSS) is an overall statistical assessment on the probability of an active business facing a situation of failure over the next 12 months.

What is a Business Credit Report used for?

What do we mean by this?

Credit Monitoring

Nobody likes unpleasant surprises – especially when it comes to unpaid creditors.

Keep an eye open on your business partners and be alerted first when they start to default on payment and fall behind industrial norms.